SERVICES – BUSINESS VALUATION

Know your worth and show it with confidence.

500+ Valuations completed across industries and deal sizes – we blend business insight with valuation rigor.

Valuing a startup is one of the trickiest tasks by the financial analyst and the valuers. The reason being, the startups at pre revenue stage and less than certain futures, the job of assigning assumptions, future cash flows etc are challenging.

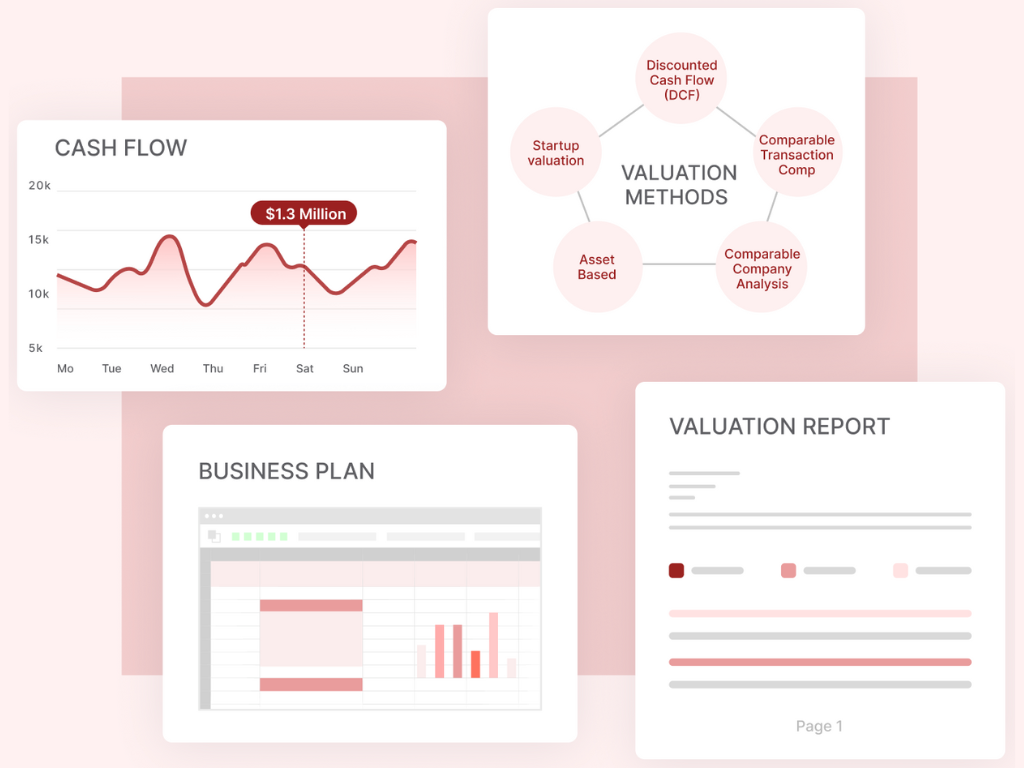

Some of the popular techniques used to assess startup valuations against the traditional methods are:

- Berkus Approach: Mr. Dave Berkus, a prominent angel investor created this method to value the startup at its pre-revenue stage by considering weights under 5 categories (a) Basic value (b) Technology risk (c) Execution risk (d) Strategic relationships in its core market and (e) Production and consequent sales.

- Scorecard Method: It is a way of determining the value of a startup with comparable companies and used particularly by pre-seed and seed-stage investors.

- Other methods: Few other methods for a valuing the startups are (a) Risk Factor Summation Method (b) The Venture Capital (VC) Method (C) Cost-to-Duplicate Approach.

The DCF method is one of the popular methods used to assess the value of a business. This method focuses on valuing a business based on capabilities to generate its future cash flows. Discount rates are applied to reflect the startups cost of capital and risk associated with cash flows it generates.

Merger and acquisition valuations are complex, because the valuation often involved issues like synergy and control, which go beyond just valuing a target firm. Ultimately, what is most important is to seek the services of valuation experts to establish a fair and reasonable value for the purchase of the company being acquired.

It is well accepted that brands or intangible assets play an important role in generating and sustaining the financial performance of businesses. Competitive advantage now depends on being able to satisfy not just the functional requirements of your customers, but also their more intangible needs.

Majorly, a branded business valuation is based on a discounted cash flow analysis of future earnings for that business discounted at the appropriate cost of capital. The value of the branded business is made up of a number of tangible and intangible assets. Trademarks are simply one of these and brands are a more comprehensive bundle of trademark and related intangibles.

Valuation of business is conducted keeping in mind that the business is a going concern. In case of liquidation valuation, it is an estimation of final value that will be received by the holder of financial instruments when an asset is sold assuming that the business is no longer a going concern.

For income tax purposes and exchange control filings, whenever company issues new shares or whenever there is a transfer of share the valuation report from a Merchant Banker is required.

Business Valuation

Whether you’re raising funds, issuing ESOPs, or planning an exit – valuation is more than a number. It’s a story backed by logic, metrics, and strategy.

We provide defensible, audit-friendly, and investor-grade valuation reports tailored to your business stage, sector, and purpose – be it for compliance, fundraising, or internal restructuring.

Business valuation is the process of assessing the total economic value of a business. Every business landscape itself in ever-evolving process by adopting new age technology, best practices etc., with one goal, that is to generate profits to its shareholders. For a business entity to attain its potential and unlock its desired valuation, it needs to incorporate specialized financial modelling and forecasting tools and techniques.

We offer business valuation services based on track record of the company, historic information and forecasting models that reflect the future outcomes.

Whether you need an advice on appropriate methodologies that will allow them to arrive at accurate value or financial forecast or a testimony from expert valuers, our professionals use reliable methodologies and provide credible results.

Our Business Valuation Services includes:

- In-depth analysis of financial modelling and forecasting

- Advisory services to allow clients to reach accurate and reliable fair value estimates

- An experienced team of experts that offers adequate mirroring of future financial projections amid all variables.

- Issue of valuation report as per the regulatory requirements.