Services – Transaction Advisory

From Term Sheet to Exit - We've Got You.

Strategic, legal, and financial guidance to drive seamless transactions.

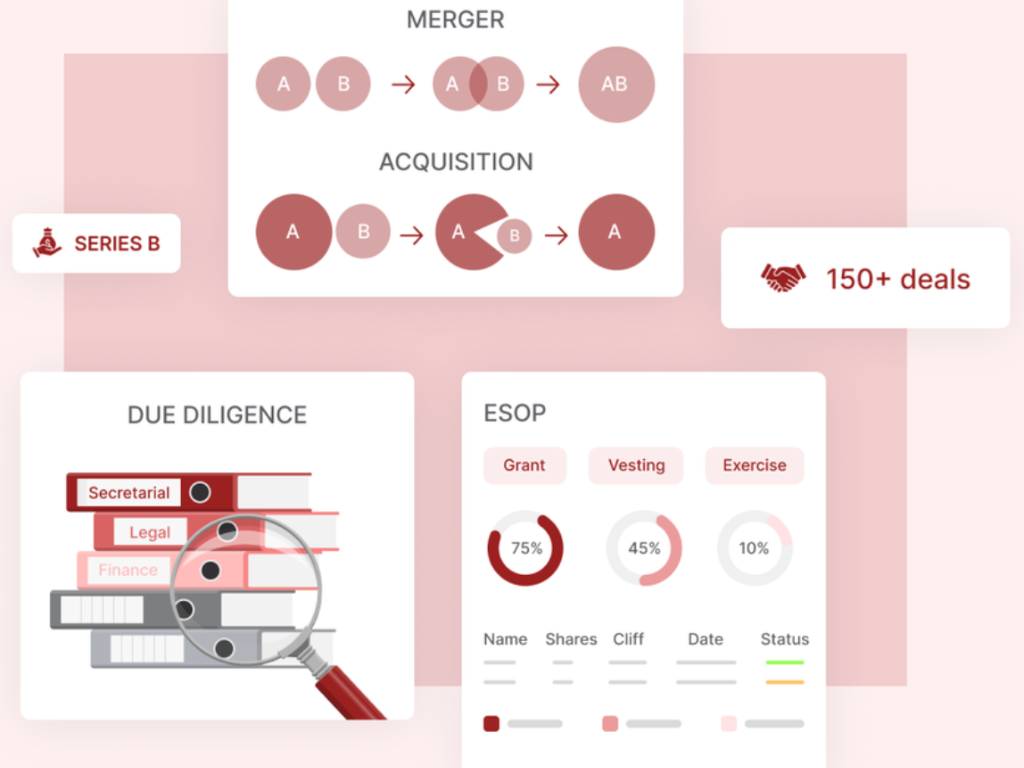

At the time of fund raise by a startup, it is critical for both the startup and the investors from due diligence point of view. For an investor it is the risk of investment and for the startup it is about receiving the funds. You need a team of professionals that understands the complexities of your transaction. Bridgehouse is flexible and tailored to your specific needs. We will work with you to help determine the appropriate scope of work.

Our diligence experts can assist you with:

- Understanding company background & value drivers

- Providing a detailed assessment on legal, secretarial and finance

- Recognising the gaps in the compliances and their potential risks

- Recognising undisclosed risks

- Providing observations and overview of the overall the compliance health of the company.

In any kind of transaction, percentage of stake in the company shareholding play a pivotal role. The transaction is structured after successful negotiation which involves analysis the business potential, company’s current and future valuation, founders’ profiles and much more. You need an expert advice who can help you navigate a favorable transaction structure. We will work with you to help determine the appropriate scope of work.

Our expertise can assist you with:

- Assessing the quality of the earning and the cash flows

- Analyze the future potential earning capabilities and company’s current valuation

- Background check of the founder’s profile

- Preparing cap table workings

Upon successful negotiation, the investors agree to invest in the startup and here comes, the numerous compliances that the Startup needs to adhere under various regulations. This can be daunting for some startups. The professionals from our team having more than a decade experience helps startups execute the required paper work in compliance with the laws.

Our expertise can assist you with:

- Drafting and vetting required paperwork for the fund raise

- Conduct required meeting as required under the law

- Fulfilment the conditions precedent as per the shareholders agreement

- Rolling out offer letter and collecting of funds

- Utilization of funds by the company

A transaction does not endwith signing the shareholders agreement or receipt of funds by the startups. There would be set of compliance requirements placed the shareholders agreement as conditions subsequent, that needs to be completed by the startups with in the timelines specified in the shareholders agreement.

Our expertise can assist you with fulfilment the conditions precedent as per the shareholders agreement.

When evaluating an acquisition or selling a business, you need to evaluate certain risks that will arise from buyer perspective and seller perspective. You need a team of professionals which understand the complexities of your transaction, foresees the risks associated and mitigate the risk by implementing effective transaction structure. We provide Sell-side and Buy-side advisory services.

Sell-Side Advisory

If you are selling a business, you need to be prepared for the due diligence conducted by the buyer. Being prepared is the key in selling a business at a strategic value. We are well equipped to represent the seller and manage all the activities till the closure of the deal. Our Sell-Side advisory includes:

- Vetting of necessary paper work required for completion of due diligence and transaction

- Fix all the compliance gap found before and after the due diligence

- Valuation analysis for the business

- Focus on areas addressed to the buyer

Buy-Side Advisory

If you are evaluating an acquisition, you need to assess potential risk that would be associated with the buyer side. You need a team of professional who understands the complexities and help in closure of the deal. Our Buy-Side advisory includes:

- Analyzing company historical performance and financial projections

- Analyzing balance sheet & cash flow movements

- Assistance in valuing acquisition

- Identifying undisclosed risks

- Support till closure of the deal

While the Fund decides to invest a particular startup, the Fund needs to mindful of risks associated, the size of each investment, the returns of capital invested, diversification of capital that needs to be deployed etc. We partner with Venture Capital Funds, Private Equity Funds, Family Offices and HNIs’ to structure their deals and strategy for funding.

Our expertise can assist you with:

- Understanding startup background & value drivers

- Providing a detailed assessment on legal, secretarial and finance status of the startup

- Recognising the gaps in the compliances and their potential risks

- Recognising undisclosed risks

- Providing observations and overview of the overall the compliance health of the startup.

Every investor, be it smaller ticket size angel investor and larger ticket size venture capital fund, looks to better returns of amount invested. A careful exit strategy needs to be exercised by the investor at the right time to get optimum returns of their capital invested.

We work with clients to implement exit strategies that will enhance better and efficient returns to the investors.

Transaction Advisory

Bridgehouse being a transaction advisory focused firm, have completed due diligence for Venture Capital Funds, HNI investors and Investment Bankers in various transactions across various industries.

Our transaction advisory services can help you navigate through your domestic and international transactions with ease and confidence. Whether you are an investor or a target company, you can be assured that we will perform the required due diligence to give you a clear perspective of the transaction and execute the deal.